County Appraiser

Valuation Process

All property in the State of Kansas is valued annually as of January 1.

Most property is valued based on its fair market value. Fair market value is the amount an informed buyer is willing to pay and an informed seller is willing to accept for property in an open market.

Sales are used in connection with cost, income, and other factors to arrive at an appraised value. Exceptions are land devoted to agricultural use, which is valued on its income or productivity, and some commercial and industrial machinery and equipment, which is valued based on a formula set forth in Kansas law.

The Appraiser’s Office can provide you with information that was used in the valuation of your property.

- A Property Record Card describes the information we have about the property, for instance square footage, room count, outbuildings, etc. Reviewing this information and alerting us to any inaccuracies allows us to ensure your valuation is correct.

- For most properties, a cost report and a comparable sales report are also available for you to review upon request.

- Commercial properties may have an income valuation report, which can also be available upon request.

If you do not agree with the valuation of your property, you may file an appeal.

The accuracy of values is an important part of a comprehensive compliance review the State of Kansas Property Valuation Division performs on the appraisal process in a county. This annual review has consistently found Douglas County to be in substantial compliance, something both citizens and employees can take pride in.

Info Session Presentation

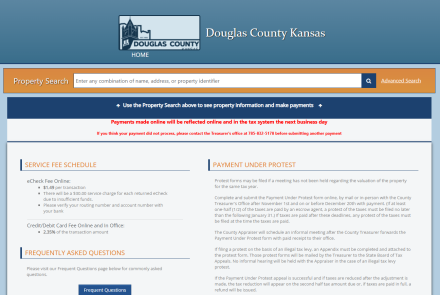

Property Search

Agricultural Use Policy

Recent Factors in Property Valuation

The Douglas County Appraiser’s Office must follow specific Kansas laws, guidelines, and procedures and must meet the compliance standards set by the State of Kansas Property Valuation Division annually. Market value is influenced by sale transactions in the marketplace. In Kansas, county appraisal offices have a legal responsibility to analyze those transactions and appraise property based upon what is happening in the marketplace.

State law requires the county appraiser to view and inspect all property in the county once every six years. Appraisal staff will also make visits to property when it sells, when a building permit is filed, and when parcel boundaries change.

The Appraiser's Office can provide you with a Property Record Card, which describes the information we have about your property, for instance square footage, room count, outbuildings, etc. Reviewing this information and alerting us to any inaccuracies allows us to ensure your valuation is…

When valuing your home, the appraiser determines the age, quality, location, condition, style and size of your property. The appraiser then uses one or more of the following three methods for your property valuation: Sales Comparison Approach: Sales of similar properties are compared to each other…

Article 11, Section 1 of The Kansas Constitution provides that real property shall be classified into seven subclasses and assessed uniformly by subclass at the following assessment percentages: Residential – 11.5%: Real property used for residential purposes including multifamily…

One sale by itself does not determine market value. A single sale may not represent the open market. The price you paid for your house is verified by the county appraiser and then considered along with sales of similar properties. The appraiser uses this information to appraise your property.

Notices of value are sent to the owner, as recorded in the Register of Deeds office, by March 1 for real property.

The value of your home may change each year and is influenced by changes in market conditions, improvements to the property, and home prices in the market area. The county appraiser continually reviews sale prices and property information throughout the year.